Texas leads nation in growth in oil and natural gas production jobs during 2013

Note: Oil and natural gas production jobs comprise the North American Industry Classifications System (NAICS) categories for oil and gas extraction, support activities for oil and gas operations, and drilling oil and gas wells.

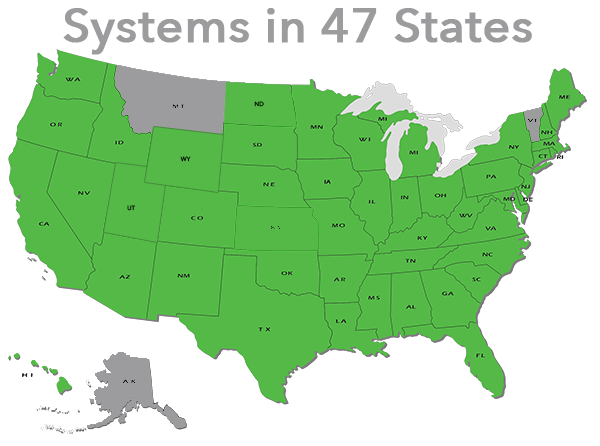

Texas added more than 19,000 new private sector jobs in oil and natural gas production in 2013, almost six times the number added in New Mexico, the next highest state for oil and natural gas production jobs added last year. The extraction, drilling, and support jobs categories are a measure of on-the-ground production jobs, and do not reflect the many jobs at oil and natural gas corporate headquarters based in Texas.

In the past decade, growth of jobs in oil and natural gas extraction, drilling, and support activities has outpaced the national average of private sector job gains. Overall, oil and natural gas production jobs in the United States increased from 292,846 annual jobs in 2003 to 476,356 in 2008, a 63% increase. Following the net loss of 54,323 oil and natural gas production jobs during the 2008-09 recession and relatively little national job growth, jobs in oil and natural gas production increased another 28% from 2009 to 2013, from 422,033 to 586,884. Additionally, average wages of oil and natural gas production jobs were $108,000 in 2013, more than twice the average wage for all private sector industries. Since 2009, average wages from oil and natural gas production jobs have increased by 12%, compared with a 10% increase for all private sector industries.

Most of the job growth has occurred in Texas, along with significant contributions from Oklahoma, New Mexico, and North Dakota. These jobs are part of the larger mining sector, which includes the extraction of coal and metals as well as oil and natural gas extraction. Many of the states that exhibit strong growth in oil and natural gas employment also show growth in mining activity and economic activity (measured as gross state product). In 2013, Texas, Oklahoma, and North Dakota were among the top states for growth in gross state product and in the mining sector.

Much of the growth in oil and natural gas jobs can be traced to growing onshore production in several shale formations in the Lower 48 states.

Texas is home to the Eagle Ford, the most prolific oil-producing play, as well as much of the Permian and Haynesville formations. North Dakota contains most of the Bakken formation, whose oil production has spurred significant employment and state product growth over the past decade in what was one of the smallest state economies. New Mexico has four large counties producing from the oil-rich Permian Basin that contains 3 of the 100 largest oil fields in the United States. Pennsylvania has seen significant job growth from natural gas production in the Marcellus region in recent years, although growth flattened during 2012-13. Colorado and Wyoming share the oil- and natural gas-producing Niobrara formation.

Preliminary national data for the first quarter of 2014 show only 1,355 net job additions from the end of 2013 through March 2014, but these data are not a complete count and do not reflect seasonality in employment.

Principal contributor: Robert McManmon