How is the fuel mix for U.S. electricity generation changing?

Last Updated: October 14, 2014

In recent years, there have been changes in the mix of fuels used to generate electricity in the United States. Natural gas and renewable energy sources have increased their role in producing the U.S. electricity supply, while coal has generally declined. In its Annual Energy Outlook, the U.S. Energy Information Administration (EIA) projects the share of electricity generated from natural gas and nonhydro renewable energy sources, such as wind and solar, will grow through 2040, while the share of other fuels, such as coal and petroleum, will decline.

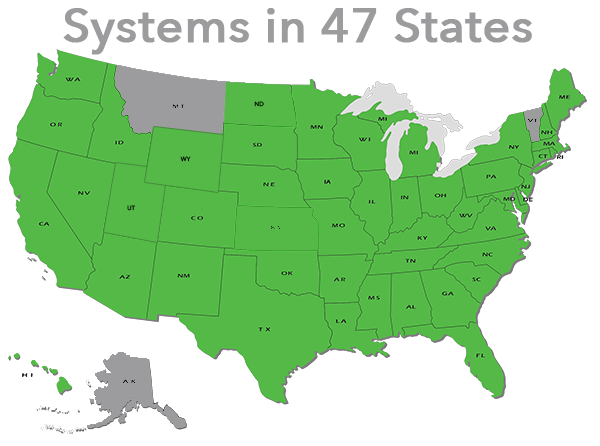

The mix of fuels used to generate electricity in the United States has changed since 1990

Since 1990, the mix of fuels that are used to generate electricity in the United States has changed. For example, in 1990 coal-fired power plants accounted for about 42% of U.S. electricity generation capacity, but produced more than half of the total electricity supply. By 2013, coal’s share of electricity generation capacity in the United States was down to 29%, and it accounted for 39% of electricity generation. Over the same period, the share of natural gas-fired electric generation capacity more than doubled from 19% in 1990 to 40% in 2013, and so did its share of actual generation, rising from 12% in 1990 to 27% in 2013. Both nuclear and hydropower electric generation capacity grew slightly during the period. Nuclear energy’s share of generated electricity supply generally held steady at about 20%. Electricity from wind experienced significant gains in its share of capacity, growing from 0.2% in 1990 to nearly 6% in 2013, and wind’s share of electric generation increased from 0.1% to 4%. Electricity generated from solar energy has also increased over this time period. There were substantial additions of utility-scale solar electric generation capacity in 2013, about 766 megawatts (MW) of solar-thermal electric capacity and 2,193 MW of solar photovoltaic (PV) capacity, mainly because several large projects in California were completed.

Source: U.S. Energy Information Administration, Annual Energy Review 2011, Table 8.11.A (September 2012), and Electric Power Monthly, Tables 6.2.A and 6.2.B (February 2014)

How are generation fuels chosen?

The major factors that have contributed to changes in the U.S. electricity generation mix are:

Declining natural gas prices Slowing growth in electricity demand Implementing federal air pollution emission regulations Meeting state requirements to use more renewable sources Using federal and state financial incentives for renewable fuelsThe declining price of natural gas was a major contributor to the rise in natural gas-fired electricity generation and the decline in coal-fired generation in recent years.

When natural gas prices are relatively low, high-efficiency, natural gas-fired combined-cycle (NGCC) power plants can supply electricity at a lower cost than coal-fired generators. Coal-fired power plants are then operated less often and earn less revenue, which decreases their profitability and attractiveness for investment in new coal-fired capacity.

Natural gas-fired generation capacity can be added in smaller increments to meet forecasted changes in electricity demand, compared to less-flexible, coal-fired generators, and nuclear power reactors. Natural gas-fired generators can also be used more quickly in response to increases in hourly electricity demand. Utilities also have lower compliance costs with environmental regulations when using natural gas, because natural gas produces fewer emissions than burning coal.

The outlook for U.S. electricity generation and capacity

Coal

Most of the existing coal-fired generation capacity in the United States is over 30 years old. Many coal-fired plants must comply with Environmental Protection Agency (EPA) regulations to reduce mercury emissions. As a result, utilities are planning to add very little new coal-fired generation capacity over the next decade, and instead plan to retire about 24 GW of existing generation capacity.1 One GW of electricity is enough to power between 750,000 and 1 million homes, depending on their size, location, and time of day.

Other includes: solar, geothermal, landfill gas, municipal solid waste, and a variety of small-magnitude fuels such as byproducts from industrial processes (e.g., black liquor and blast furnace gas).

Source: U.S. Energy Information Administration, Form EIA-860 Annual Electric Generator Report

EIA projects that about 50 GW of coal-fired capacity will be retired by 2020, with only about 2 GW of new capacity added. Although a significant number of coal-fired power plants are retired early in the projection period, the reduction in coal-fired generation is not proportional to the decline in capacity, because many of the remaining coal-fired plants may be operated at higher utilization rates. Despite those retirements, EIA projects coal will continue to account for the largest share of the electricity generation fuel mix in the United States through 2034, and then be overtaken by natural gas through 2040.

Source: U.S. Energy Information Administration (EIA), Annual Energy Outlook 2014, Reference Case. (April 2014)

Natural gas

Electric power producers have reported planned natural gas-fired capacity additions of about 29 GW through 2018, and retirement of about 5 GW of existing capacity.1 As a result, EIA projects that natural gas will account for 35% of total electricity generation in 2040. Much of the new natural gas-fired capacity uses combined cycle technology, which is relatively economical for supplying peak and baseload electricity demand.

Nuclear power

In 2012 and 2013, operators of six nuclear power reactors with 4.8 GW of combined generating capacity announced plans to retire the reactors. Four of those reactors have already stopped operations, while the other two reactors with 0.6 GW of capacity are scheduled to be retired by the end of 2014 and 2019 respectively. Five new reactors with a combined capacity of about 5.5 GW are under or planned for construction by 2018. Two other reactors with a total of 2.2 GW of capacity are planned to come online by 2022.1 EIA projects that nuclear power will supply 16% of U.S. electricity generation in 2040.

Renewables

About 1 GW of new hydropower generation capacity, 22 GW of new wind generation capacity, and 9 GW of new utility-scale solar generation capacity are planned through 2018.

EIA projects that new wind generation capacity additions will not increase substantially after 2020. However, EIA projects that solar generation capacities will more than double by 2040, with the majority being photovoltaic systems installed by homeowners and other end users of electricity. EIA also projects that geothermal capacity will more than double, and that hydropower and wind will account for the largest shares of electricity generated from renewable energy sources through 2040.